What is the main disadvantage of bank account?

Savings Account Disadvantages

- Interest rates can change. Savings account interest rates in India can fluctuate, leading to variable returns. ...

- Minimum balance requirements. ...

- Withdrawal limits. ...

- Inflation. ...

- Compounded interest.

The FDIC insures nearly all banks up to $250,000 per depositor, per bank. Your savings could be at risk if your account is compromised, though federal law does offer you some protection. Amassing a lot of money in your account can also be risky, especially if you're trying to save for long-term goals.

- Interest Rates Can Vary. Interest rates for both traditional and high-yield savings accounts can vary along with the federal funds rate, the benchmark interest rate set by the Federal Reserve. ...

- May Have Minimum Balance Requirements. ...

- May Charge Fees. ...

- Interest Is Taxable.

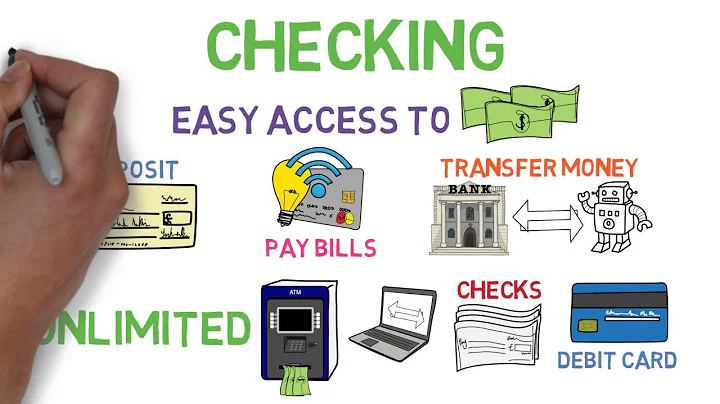

Potential downsides to most types of checking accounts can include: Usually does not earn interest. Monthly service fees. Overdraft fees.

Among the disadvantages of savings accounts: Interest rates are variable, not fixed. Inflation might erode the value of your savings. Some financial institutions require a minimum balance to earn the highest interest rate.

Opening a bank account can be one of the most important steps you take toward reaching your financial goals. Why? Because putting your money in an FDIC-insured bank account can offer you financial safety, easy access to your funds, savings from check-cashing fees, and overall financial peace of mind.

The major risks faced by banks include credit, operational, market, and liquidity risks. Prudent risk management can help banks improve profits as they sustain fewer losses on loans and investments.

- First Republic Bank (FRC) . Above average liquidity risk and high capital risk.

- Huntington Bancshares (HBAN) . Above average capital risk.

- KeyCorp (KEY) . Above average capital risk.

- Comerica (CMA) . ...

- Truist Financial (TFC) . ...

- Cullen/Frost Bankers (CFR) . ...

- Zions Bancorporation (ZION) .

Low Interest, Poor Return

In fact, one great disadvantage to savings accounts is that they offer low interest rates, which means a poor return for you. In fact, the returns may be so low that you risk inflation eating away at the value of your deposit.

Is it a good idea to open a savings account?

But if you're looking to set aside money for future needs and goals, opening a savings account is an option to consider. Saving a percentage of your income and putting it into a savings account can help you grow your savings while building a safety net fund.

Key Takeaways. Savings accounts are a safe place to keep your money because all deposits made by consumers are guaranteed by the FDIC for bank accounts or the NCUA for credit union accounts. Certificates of deposit (CDs) issued by banks and credit unions also carry deposit insurance.

You can use the checking account for everyday financial transactions and the savings account to set aside money for emergencies or other financial goals.

A money market account (MMA) is a savings account that typically pays higher interest rates than regular savings accounts. MMAs usually offer tiered rates, meaning you can earn an even higher rate on large balances or on part of your balance over a certain level.

If you really value a face-to-face customer experience and are willing to forfeit a higher return on your money for it, then a brick-and-mortar savings account is for you. On the other hand, if you care most about high interest rates and low fees, an online (high-yield) savings account is the better choice.

The best type of account is the one that fits your current financial goals and needs. Checking accounts can help you handle all of your daily spending and recurring bills, while savings accounts can help you build your savings, protect you from unexpected expenses and help meet your savings goals.

A liquid savings account is a safe place to keep some money that's easily accessible. Insurance from the Federal Deposit Insurance Corp. (FDIC), which covers up to $250,000 per person, per account type at an FDIC-insured bank, means that your savings are protected by the federal government if your bank fails.

In the long run, your cash loses its value and purchasing power. Another red flag that you have too much cash in your savings account is if you exceed the $250,000 limit set by the Federal Deposit Insurance Corporation (FDIC) — obviously not a concern for the average saver.

Instead, you may be better off looking into an investment account that lets you buy stocks, bonds, mutual funds, or exchange-traded funds (ETFs). While they're riskier than throwing your money into savings, they typically have much higher returns.

As long as your deposit accounts are at banks or credit unions that are federally insured and your balances are within the insurance limits, your money is safe. Banks are a reliable place to keep your money protected from theft, loss and natural disasters. Cash is usually safer in a bank than it is outside of a bank.

Why is it a good idea to keep your money in a bank account?

Your money will be protected from theft and fires. Plus, your money will be federally insured so if your bank or credit union closes, you will get your money back. The maximum amount of money that can be insured is $100,000. Many banks offer an interest rate when you put your money in a savings account.

For savings, aim to keep three to six months' worth of expenses in a high-yield savings account, but note that any amount can be beneficial in a financial emergency. For checking, an ideal amount is generally one to two months' worth of living expenses plus a 30% buffer.

Examples of high-risk transactions

This can include purchases made online, over the phone, or through email. Unfortunately, this type of payment is considered high-risk as it makes it easier for fraudsters to use stolen credit card numbers without presenting a physical card.

There is a systemic risk of large-scale bank failures in the U.S. in 2024 due to charge-offs and write-downs emanating from the commercial real estate sector. Bank regulators have been vocal about their concerns that the too-big-too-fail banks would have sufficient capital to cover losses and a recession.

Culture is a bank's most valuable and riskiest asset, and should be treated as such.

References

- https://www.barrons.com/articles/small-community-banks-are-teetering-expect-more-failures-a3de6f78

- https://www.nerdwallet.com/article/finance/envelope-system

- https://tech.co/pos-system/cashless-society-stats-pros-cons

- https://www.investopedia.com/articles/younginvestors/08/purchase-financing.asp

- https://www.investopedia.com/ask/answers/12/safest-place-for-money.asp

- https://fortune.com/recommends/banking/types-of-savings-accounts/

- https://www.bankrate.com/investing/saving-vs-investing/

- https://finance.yahoo.com/news/experts-8-surprising-reasons-why-180012162.html

- https://www.bloomberg.com/opinion/articles/2023-08-03/actually-most-americans-can-come-up-with-400-in-an-emergency

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/risk-management/major-risks-for-banks/

- https://www.chase.com/personal/banking/education/basics/checking-vs-savings-account

- https://www.cnbc.com/select/brick-and-mortar-banks-vs-online-banks/

- https://www.investopedia.com/terms/p/pettycash.asp

- https://www.experian.com/blogs/ask-experian/pros-and-cons-of-savings-accounts/

- https://www.cnbc.com/select/can-you-have-too-much-in-savings/

- https://www.investopedia.com/articles/fundamental/03/062503.asp

- https://smallbusiness.chron.com/risks-savings-account-43422.html

- https://www.sofi.com/learn/content/consequences-of-not-saving-money/

- https://typeset.io/questions/what-are-the-advantages-and-disadvantages-of-cash-payments-kb326tebwa

- https://www.investopedia.com/articles/personal-finance/092214/credit-card-or-cash.asp

- https://midpennbank.com/understanding-the-four-types-of-banking-accounts/

- https://www.brookings.edu/articles/cash-will-soon-be-obsolete-will-america-be-ready/

- https://www.thestreet.com/personal-finance/banks-most-at-risk-morningstar

- https://consumer.westchestergov.com/money-management/benefits-of-a-bank-account

- https://www.fdic.gov/getbanked/pdf/top-reasons-to-open-a-bank-account.pdf

- https://www.ptla.org/pre-paid-debit-cards-are-they-good-deal

- https://www.chase.com/personal/banking/education/budgeting-saving/the-best-reasons-to-open-a-savings-account

- https://www.waldenu.edu/online-doctoral-programs/phd-in-public-policy-and-administration/resource/should-we-become-a-cashless-society

- https://www.ecb.europa.eu/euro/cash_strategy/cash_role/html/index.en.html

- https://www.moneyland.ch/en/cash-pros-and-cons

- https://www.nerdwallet.com/article/banking/is-my-money-safe-in-a-bank

- https://www.nibusinessinfo.co.uk/content/advantages-and-disadvantages-bank-loans

- https://www.axisbank.com/progress-with-us-articles/advantages-and-disadvantages-of-savings-account

- https://www.bankdirector.com/article/a-banks-most-valuable-and-riskiest-asset/

- https://www.forbes.com/advisor/banking/checking-vs-savings-accounts/

- https://www.hostmerchantservices.com/articles/difference-between-high-risk-and-low-risk-transaction/

- https://www.bankrate.com/banking/savings/can-you-have-too-much-in-savings/

- https://www.fool.com/the-ascent/banks/articles/are-savings-accounts-100-risk-free-the-answer-is-no-for-these-scenarios/

- https://www.linkedin.com/pulse/leading-cash-carry-brands-across-globe-your-retail-coach-yrc-

- https://www.linkedin.com/advice/0/what-pros-cons-using-cash-only-budgeting-system-skills-budgeting

- https://www.oneazcu.com/about/financial-resources/saving-budgeting/which-savings-account-will-earn-you-the-most-money/

- https://www.nerdwallet.com/article/banking/how-much-should-i-have-in-savings

- https://www.online.citibank.co.in/blog/citi-knowledge-center/why-credit-debit-cards-are-better.html

- https://ntctexas.com/the-pros-and-cons-of-being-a-cash-only-business

- https://www.sofi.com/learn/content/cash-only-living-pros-and-cons/

- https://www.dspmuranchi.ac.in/pdf/Blog/8)%20DEMERITS%20OF%20MONEY.pdf

- https://www.usnews.com/banking/articles/what-is-a-savings-account

- https://blog.qubemoney.com/11-disadvantages-of-cash/